portland oregon sales tax 2021

The Portland Sales Tax is collected by the merchant on all qualifying sales made within Portland. All businesses must register Registration form or register online If you qualify for.

Portland Or Travel Guide U S News Travel

Where will my Portland property taxes go in 2021.

. Portland oregon sales tax 2021 Thursday February 24 2022 Edit Best Airbnbs In Portland Oregon 19 Top Places To Stay In 2021 Magical. Portland property tax payers fund everything from regional water quality to affordable housing. Individual fiscal year filers.

Many other states are formalizing guidance through laws and regulations regarding collecting sales tax on online sales. The Portland Oregon sales tax is NA the same as the Oregon state sales tax. Business Tax Return Filing Requirements.

He has been licensed. Oregon Department of Rev - enue PO Box 14950 Salem OR 97309-0950. There are no local taxes beyond the state rate.

Online Services We offer a variety of online services including business registration uploading tax pages filing a returnextension exemptions and payments. The County sales tax rate is. Has impacted many state nexus laws and sales tax collection.

What is the sales tax rate in Portland Oregon. Sales tax region name. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

Marginal tax rates start at 475 percent and as a taxpayers income goes up rates quickly rise to 675 percent and 875. This is the total of state county and city sales tax rates. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities.

Among major cities Tacoma Washington imposes the highest combined state and local sales tax rate at 1030 percent. Tax rates last updated in January 2022. The company conducted more than 200 transactions to South Dakota.

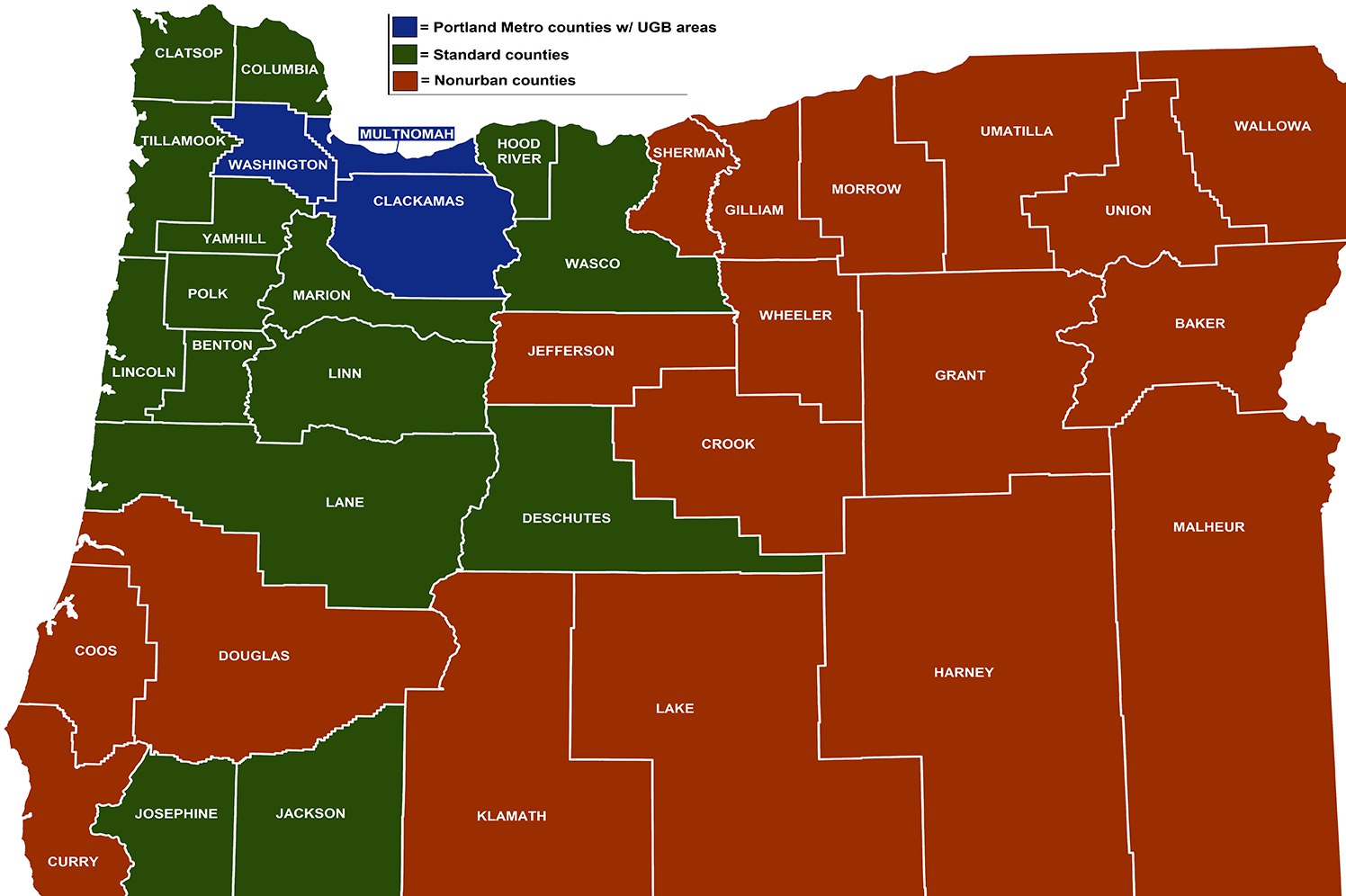

The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. Oregon imposes new local income taxes for Portland Metro and Multnomah County. Oregons personal income tax is progressive but mildly so.

The 2018 United States Supreme Court decision in South Dakota v. The Multnomah County sales tax rate is. The minimum Heavy Vehicle.

The new revenue-raiser joins several existing taxes including a measure passed in May 2020 to fund supportive services for persons who are homeless or at risk of becoming. The state sales tax rate in Oregon is 0000. In our property tax update for 2021 we highlighted three newly passed ballot measures from November 2020 that increased property tax in 2021 that will continue into.

Most states have a sales. For the tax years beginning on or after January 1 2020 this tax is 3 percent of the total Oregon Weight-Mile Tax calculated for all periods within the tax year. Certain business activities are exempt from paying business taxes in Portland andor Multnomah County.

Portland Oregons Sales Tax Rate is 0 IRSgov 2021 2. While many other states allow counties and other localities to collect a local option sales tax Oregon does not permit local sales taxes to be collected. The vehicle use tax applies to Oregon residents and businesses that purchase vehicles outside of Oregon.

The minimum combined 2022 sales tax rate for Portland Oregon is. Effective January 1 2021 two new Oregon local income taxes apply the Portland Metro Supportive. In Newport Measure 21-205 proposed a 5 tax which would have applied to the sale of prepared food and beverages.

The companys gross sales exceed 100000 or. There are six additional tax districts that apply to some areas. For example under the South Dakota law a company must collect sales tax for online retail sales if.

If youre an individual fiscal year filer and your tax year begins in 2021 you should file on a 2021 tax return. The Oregon sales tax rate is currently. Exact tax amount may vary for different items.

It would have funded a range of public services including. Oregon is one of 5 states that does not impose any sales tax on purchases made in. How should I file my return.

Method to calculate Portland sales tax in 2021. Frequently asked questions I have more than one business. Portland Tourism Improvement District Sp.

Instead the state generates revenue. Wayfair Inc affect Oregon. 2022 Oregon state sales tax.

The Portland sales tax rate is. Taxfilers must file their business tax returns and pay their business tax liability at the same time they file their federal and state income tax returns. Did South Dakota v.

Mailed with Form OR-TM-V to. Five other citiesFremont Los Angeles and Oakland.

City Guide Portland Oregon Go Next

Cost Of Living In Portland Or Upnest

What Living In Portland Is Like Is Moving To Portland A Good Idea

16 Best Things To Do In Portland Oregon Conde Nast Traveler

Singing Christmas Tree Portland Singing Christmas Tree Downtown Portland Portland

Property Tax Bills To Be Mailed This Week At Least Small Increases In Store For Most In Portland Metro Oregonlive Com

Portland Oregon Travel Guide At Wikivoyage

/shutterstock_178351457-5bfc365646e0fb00517e18e7.jpg)

Taxes In Oregon For Small Business The Basics

The Top 10 Reasons To Move To Portland Or Home Money

Take Your Pick From Over 5 Different Travel Itineraries Stay In Wilsonville Just 16 Miles South Of Portland Video In 2021 Fun Family Trips Travel Fun Wilsonville

Oregon State 2022 Taxes Forbes Advisor

Oregon Enacts Two New Local Income Taxes For Portland Metro Multnomah County Primepay

20 Honest Pros And Cons Of Living In Portland Oregon Tips

Oregon Tax Rates Rankings Oregon State Taxes Tax Foundation

Pin On For The Love Of The Us West Coast Oregon Travel Portland Travel Travel Usa

Oregon Minimum Wage In 2022 Square